Top DeFi Protocols Solana

DeFi has been a core pillar of crypto for years, yet on Solana, it’s often overshadowed by other parts of the ecosystem. I believe that DeFi is at the heart of every on-chain economy.

With that said we’ll dive into the Sol ecosystem focusing on the top five DeFi protocols by Total Value Locked (TVL). Also we will analyse:

Fees - gross revenue inclusive of pay outs to Liquidity providers (LP),

Revenue - gross revenue to the protocol less LP fees,

Earnings - net income to the protocol,

Incentives - revenue shared to token holders.

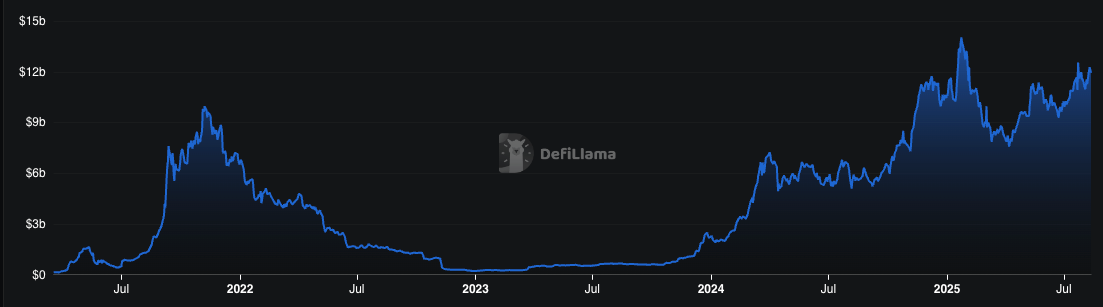

Solana’s DeFi TVL has grown exponentially since inception, starting at about $148 million in March 2021 and rising to $11.95 billion in August 2025, weathering some of the most make/break periods in crypto history faced with scandals like FTX and Luna collapses.

In January 2025, DeFi TVL on Solana peaked at $13.78 billion, the space was filled with euphoria a crypto-friendly administration had just been elected in the USA. However, there was underlying weakness in global liquidity extensive research on this can be found at Michael Howell Substack, where he highlighted the underlying liquidity drivers were signalling a weak Q1 2025 for risk assets and that included the crypto space. This weakness played out eventually leading to a pullback of about 88.53% to $7.58 billion in April 2025, from the peak in January 2025. Their research highlights a three-month lag between impulses in liquidity and corresponding shifts in risk-on activity, meaning the Q1 drawdown reflected liquidity tightening that began in late 2024.

Since then, improving liquidity conditions, the fading of recession fears, and the calming of major geopolitical shocks have driven a 57.65% rebound, bringing Solana’s DeFi TVL back to $11.95 billion as of August 2025.

Solana DeFi Total Value Locked

Source: DefiLlama

1. Kamino Finance

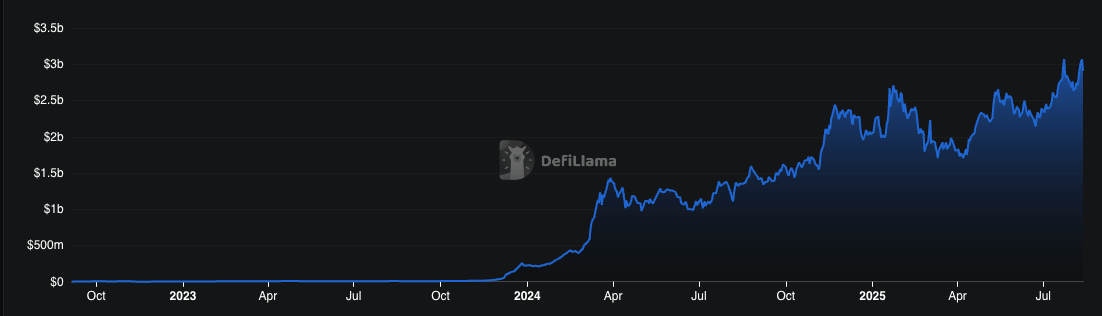

Kamino Finance is a leading protocol that unifies lending, liquidity provision, and leverage into a single platform. It began as an auto-compounding concentrated liquidity vault system, designed to maximise capital efficiency on DEXs like Raydium, Orca, and Jupiter. Today, it's grown into Solana's largest lending protocol, powering a sizeable portion of its DeFi activityIt holds the largest pool of liquidity on Solana, with TVL at $3.04 billion, representing roughly 24% of the entire Solana DeFi TVL.

Kamino Finance’s TVL performance has been remarkable compared to the broader Sol DeFi market. It has already surpassed its January 2025 peak, even though total Solana DeFi TVL has yet to reclaim those levels. In Q1 2025, during the global liquidity pullback, Kamino’s TVL declined by only 36.91% from $2.709 billion in January to $1.709 billion in April, compared to an 88.53% drop in total Solana DeFi TVL over the same period. This resilience points to a strong and sticky user base. Since that low, Kamino’s TVL has grown 70.45% to $2.91 billion, outperforming the recovery in Solana’s overall DeFi TVL and signalling not just user retention, but strong user growth as well.

Kamino Finance Total Value Locked

Source: DefiLlama

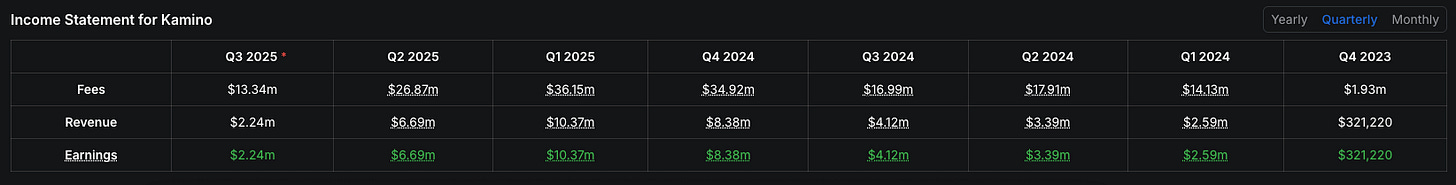

From Q1 2024 to Q1 2025, both fees and revenue increased materially, reflecting rising on-chain activity and deeper protocol adoption. Quarterly fees grew from $14.13 milion in Q1 2024 to a peak of $36.15 million in Q1 2025, while revenue followed a similar trajectory, peaking at $10.37 million in the same period. Earnings, which in this table match reported revenue (implying minimal operating expenses in this view), also peaked at $10.37 million in Q1 2025.

However, Q2 2025 saw a contraction in fees, revenue, and earnings, falling to $26.87 million, $6.69 million, and $6.69 million, respectively. In Q3 2025 (to date), Kamino has recorded $13.34 million in fees, $2.24 million in revenue, and $2.24 million in earnings. This means that less than halfway into the quarter, Kamino has already generated 49.64% of Q2’s fees and 33.47% of its revenue and earnings, signalling a strong rebound in activity.

Kamino Finance Income Statement

Source: DefiLlama

2. Jito

Jito is a liquid staking platform that issues JitoSOL, letting users earn both standard staking rewards and additional yield from MEV (Maximum Extractable Value). This MEV comes from Solana validators capturing profits through strategies like arbitrage, liquidations, and sandwich trades, with a portion redistributed to stakers.

Jito’s TVL has grown rapidly since its launch, reflecting both the adoption of liquid staking on Solana and the additional MEV yield it offers to stakers. From under $4 million in late 2022, TVL expanded steadily throughout 2024, breaking above $1 billion by Q1 2024 and maintaining strong growth momentum.

The protocol saw an acceleration in inflows towards the end of 2024, coinciding with improved sentiment in Solana DeFi and a broader risk-on environment in crypto markets. By early 2025, Jito’s TVL peaked at just under $4 billion, supported by both organic staking growth and users rotating from native SOL staking to JitoSOL for higher yield potential.

Despite volatility in the first half of 2025, TVL has remained resilient, consistently holding above $2 billion a sign of strong user stickiness. This stability suggests that a significant portion of Jito’s TVL is long-term staking capital rather than short-term opportunistic flows, reinforcing its position as a core liquid staking protocol on Solana.

Jito Total Value Locked

Source: DefiLlama

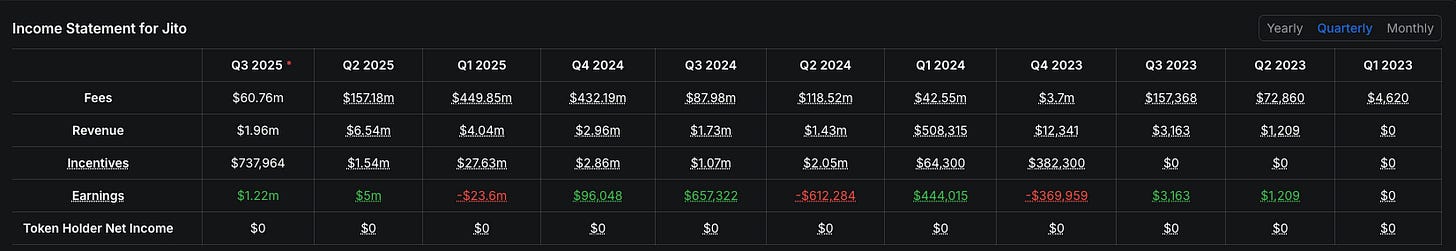

From Q1 2024 to Q1 2025, Jito experienced substantial growth in both fees and revenue, underpinned by the rising adoption of liquid staking and its MEV yield proposition. Quarterly fees climbed from $42.55 million in Q1 2024 to an all-time high of $449.85 million in Q1 2025, while revenue increased from $0.51 million to $4.04 million over the same period. However, high incentive payouts in Q1 2025 led to negative earnings of -$23.60 million, highlighting the cost of aggressive growth and user acquisition.

Q2 2025 marked a steep decline in fees to $157.18 million and revenue to $6.54 million, reflecting the cooldown in network activity and reduced market volatility. Earnings rebounded to $5.00 million as incentives dropped sharply, suggesting improved cost discipline.

In Q3 2025 (to date), Jito has recorded $60.76 million in fees and $1.96 million in revenue, with $1.22 million in earnings. This represents 38.65% of Q2’s fees, 29.97% of its revenue, and 24.40% of its earnings, a sign of recovery in activity.

Jito Income Statement

Source: DefiLlama

3. Jupiter

Jupiter launched in 2021 as a Dex aggregator designed to solve Solana’s fragmented liquidity problem and deliver better execution for traders. Since then, it has evolved into a full-fledged DeFi super-app, adding services such as perpetuals trading, a launchpad for new tokens (LFG Launchpad), portfolio tools, and advanced trade automation, making it far more than “just a Dex”.

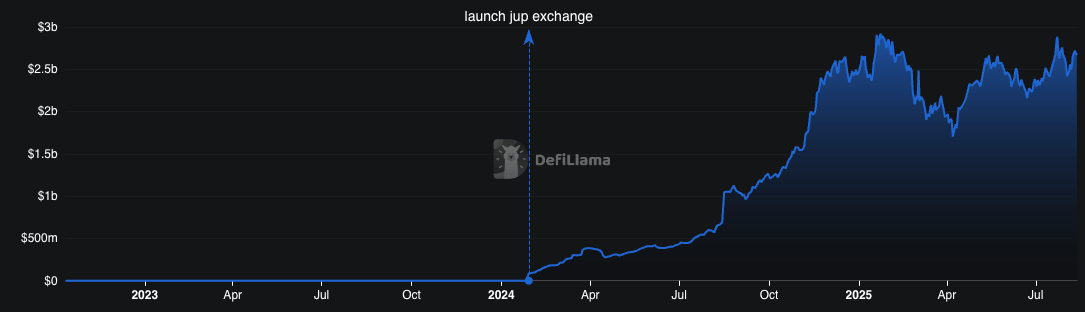

Jupiter’s TVL growth accelerated after the launch of the JUP exchange in early 2024, marking its transition from a Dex aggregator to a full-service DeFi platform. From near-zero at the start of 2024, TVL climbed past $1 billion by September and surged to just under $3 billion in early 2025. The Q1 2025 drawdown in TVL reflected the consistent three-month lag between global liquidity tightening and its impact on DeFi activity as we have seen in Kamino and Jito, conditions that started weakening in Q4 2024. Despite that headwind, Jupiter rebounded quickly, maintaining TVL above $2.5 billion through mid-2025, driven by sustained demand for its swap product and growing adoption of perpetual trading and its LFG Launchpad.

Jupiter Total Value Locked

Source: DefiLlama

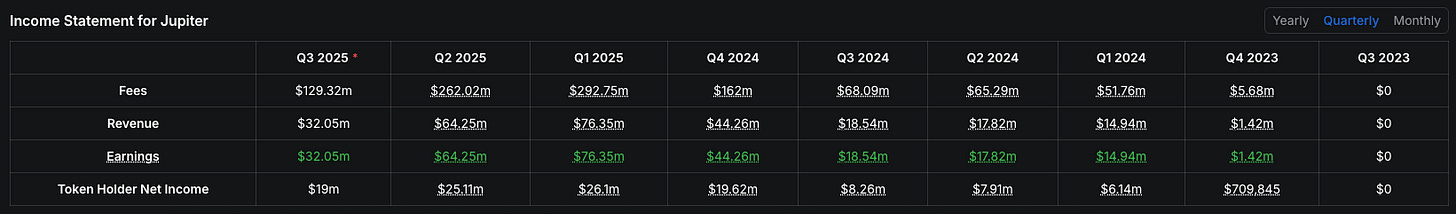

From Q4 2023 to Q1 2025, Jupiter experienced significant growth in fees, revenue, and earnings, reflecting both rising on-chain trading volumes and its expansion into new services beyond Dex aggregation. Quarterly fees climbed from $5.68 million in Q4 2023 to a peak of $292.75 million in Q1 2025. Revenue and earnings followed a similar trajectory, both reaching $76.35 million at their peak in Q1 2025.

Q2 2025 saw a contraction, with fees falling to $262.02 million and revenue/earnings to $64.25 million, still historically high but below peak. In Q3 2025 (to date), Jupiter has generated $129.32 million in fees and $32.05 million in revenue/earnings, representing 49.35% and 49.87% of Q2 2025’s totals, respectively.

Notably, Jupiter also distributes a portion of its revenue directly to token holders. Token Holder Net Income peaked at $26.10 million in Q1 2025, fell to $25.11 million in Q2, and stands at $19.00 million so far in Q3 2025, underscoring its role as one of the few Solana DeFi protocols with direct value accrual to token holders.

Jupiter Income Statement

Source: DefiLlama

4. Sanctum

Sanctum is a Solana protocol that makes liquid staking tokens (LSTs) like JitoSOL, mSOL, and bSOL easy to swap between each other. Instead of keeping these assets in separate, hard-to-trade pools, Sanctum combines their liquidity in one “Infinity Pool,” so users can move between different LSTs with low slippage and quick access to SOL. This makes it easier for stakers to choose the best-performing or most useful LST at any time, boosting flexibility and capital efficiency across Solana DeFi.

Sanctum’s TVL has grown quickly since its early 2024 launch, driven by its role as the main liquidity hub for Solana’s LSTs. From sub $50.00 million, TVL surged past $1.00 billion by mid-2024 and continued climbing, peaking above $2.50 billion in July 2025. While there have been fluctuations, Sanctum has held a strong upward trajectory, staying above $900 million through the downturn in liquidity. This growth reflects increasing demand for LSTs like JitoSOL, mSOL, and bSOL, and the protocol’s Infinity Pool has made swapping between them seamless, keeping liquidity active and accessible across the Solana DeFi ecosystem.

Also, this protocol shows a similar trend like Kamino Finance which has surpassed its January peak by 23.33% as of August 2025, a signal that users are adopting their innovative services.

Sanctum Total Value Locked

Source: DefiLlama

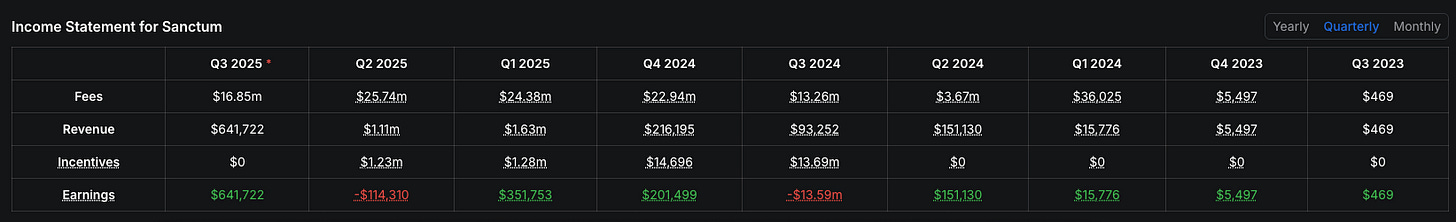

From Q1 2024 to Q1 2025, Sanctum’s fees and revenue saw notable growth, reflecting its rapid adoption as a core LST liquidity hub on Solana. Quarterly fees rose from $36,025 in Q1 2024 to $24.38 million in Q1 2025, while revenue climbed from $15,776 to $1.63 million over the same period. Earnings generally tracked revenue, but Q3 2024 and Q2 2025 saw dips into negative territory due to high incentive payouts, with Q3 2024 recording a $13.59 million loss and Q2 2025 a smaller $114,310 loss.

Despite these occasional drawdowns, Sanctum has returned to profitability in Q3 2025, posting $641,722 in earnings so far. While the ongoing Q3 2025 fees of $16.85 million are 65.46% of Q2’s $25.74 million, indicating healthy on-chain activity, particularly given that revenue and earnings have stayed positive without incentive spending.

Sanctum Income Statement

Source: DefiLlama

5. Raydium

Raydium is one of Solana’s oldest and largest decentralised exchanges, combining an automated market maker (AMM) with an order book through its integration with OpenBook, the community-run successor to the former Serum Dex. This hybrid model lets users swap tokens with the efficiency of AMMs while also tapping into deeper liquidity from the order book. Beyond swaps, Raydium offers liquidity pools, yield farming, and a launchpad for new tokens. As a core liquidity hub on Solana, it plays a major role in supporting both retail traders and DeFi protocols that rely on deep, fast on-chain markets.

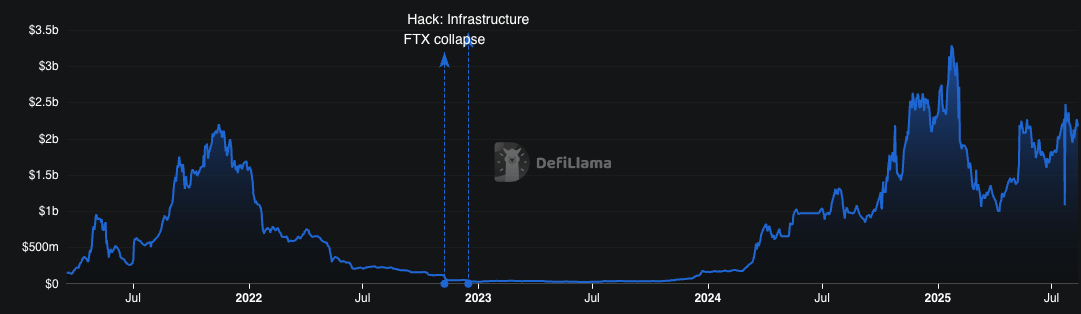

Raydium’s TVL history reflects both the highs and lows of Solana DeFi. In late 2021, TVL surged past $2.0 billion, driven by Solana’s breakout moment during the bull market. However, 2022 brought sharp drawdowns, with TVL collapsing alongside the broader market amid the FTX collapse and infrastructure hack in late 2022. For most of 2023, TVL remained below $50 million.

A recovery began in November 2023, coinciding with renewed Solana ecosystem growth, lifting Raydium’s TVL to a peak of $3.26 billion in January 2025. Raydium has held well above $900 million throughout 2025, cementing its role as one of Solana’s largest liquidity hubs.

This resilience is further reflected in trading activity: through 2025, Raydium has contributed roughly 30% of all Dex volume on Solana, about one in every three trades routes through the protocol.

Raydium Total Value Locked

Source: DefiLlama

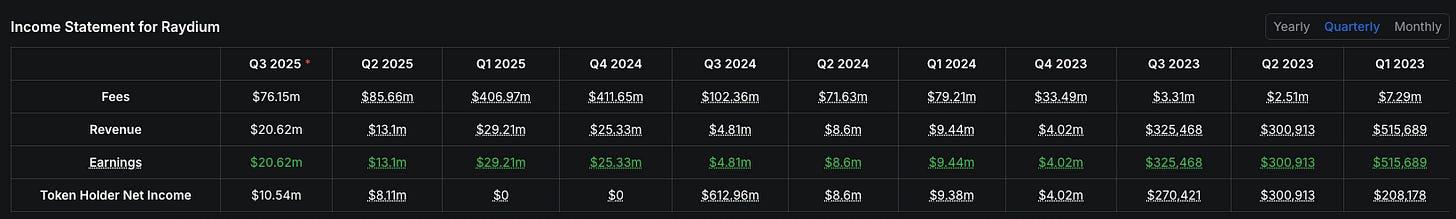

From Q1 2024 to Q1 2025, Raydium’s fees and revenue grew significantly, underscoring its position as one of Solana’s largest liquidity hubs. Quarterly fees rose from $79.21 million in Q1 2024 to an impressive $406.97 million in Q1 2025, while revenue climbed from $9.44 million to $29.21 million over the same period. Earnings followed a similar trajectory, peaking at $29.21 million in Q1 2025.

However, Q2 2025 saw a sharp contraction in both fees and revenue as broader market liquidity conditions cooled. Fees fell to $85.66 million, and revenue dropped to $13.10 million. The rebound in Q3 2025 has been notable with fees at $76.15 million and revenue at $20.62 million, much of this resurgence can be attributed to the explosive growth of LetsBONK.fun, a BONK ecosystem memecoin launchpad built on Raydium.

Launched in April 2025, LetsBONK.fun quickly overtook Pump.fun in daily trading volume and token launches, generating over $1 million in daily fees by July. On August 9, 2025, Raydium’s LaunchLab recorded $900,000 in daily fees, surpassing its swap revenue for the first time. This surge in memecoin launchpad activity has driven substantial traffic and liquidity to Raydium’s pools, directly boosting protocol revenues in Q3 2025 despite the still-recovering broader DeFi environment.

Raydium Income Statement

Source: DefiLlama

The performance of Solana’s top five DeFi protocols in 2025 underscores two key themes: protocol-specific resilience and the outsized influence of global liquidity conditions. While the January 2025 TVL peak of $13.78 billion reflected a euphoric macro backdrop following the election of a crypto-friendly U.S. administration, the subsequent Q1 drawdown — an 88.53% drop to $7.58 billion — validated the three-month lag between liquidity tightening and its impact on risk assets, a dynamic well-documented in macro liquidity research.

Across the board, the protocols that have outperformed since the April 2025 low share three characteristics:

Product-market fit with sticky user bases (e.g., Kamino’s integrated lending-liquidity-leverage model and Jito’s MEV-enhanced staking),

Innovative product expansions that generate new revenue streams (e.g., Jupiter’s perpetuals and launchpad, Raydium’s LetsBONK.fun-driven memecoin surge), and

Strategic positioning in core DeFi infrastructure (e.g., Sanctum’s Infinity Pool for LST liquidity).

Kamino and Sanctum have already surpassed their January TVL peaks, a rare feat in this cycle, signalling that certain Solana DeFi segments are experiencing structural growth, not just cyclical recovery. Jito’s stability above $1.5 billion TVL reinforces the durability of liquid staking demand, while Jupiter and Raydium show that trading venues can rebound quickly when supported by high-engagement products like launchpads.

Looking forward, the sustainability of this recovery will hinge on the direction of global liquidity and macro risk sentiment. If liquidity conditions continue to improve into late 2025, Solana’s DeFi sector is well-positioned not only to retest January’s $13.78 billion TVL high, but to set new records in both on-chain activity and protocol profitability.